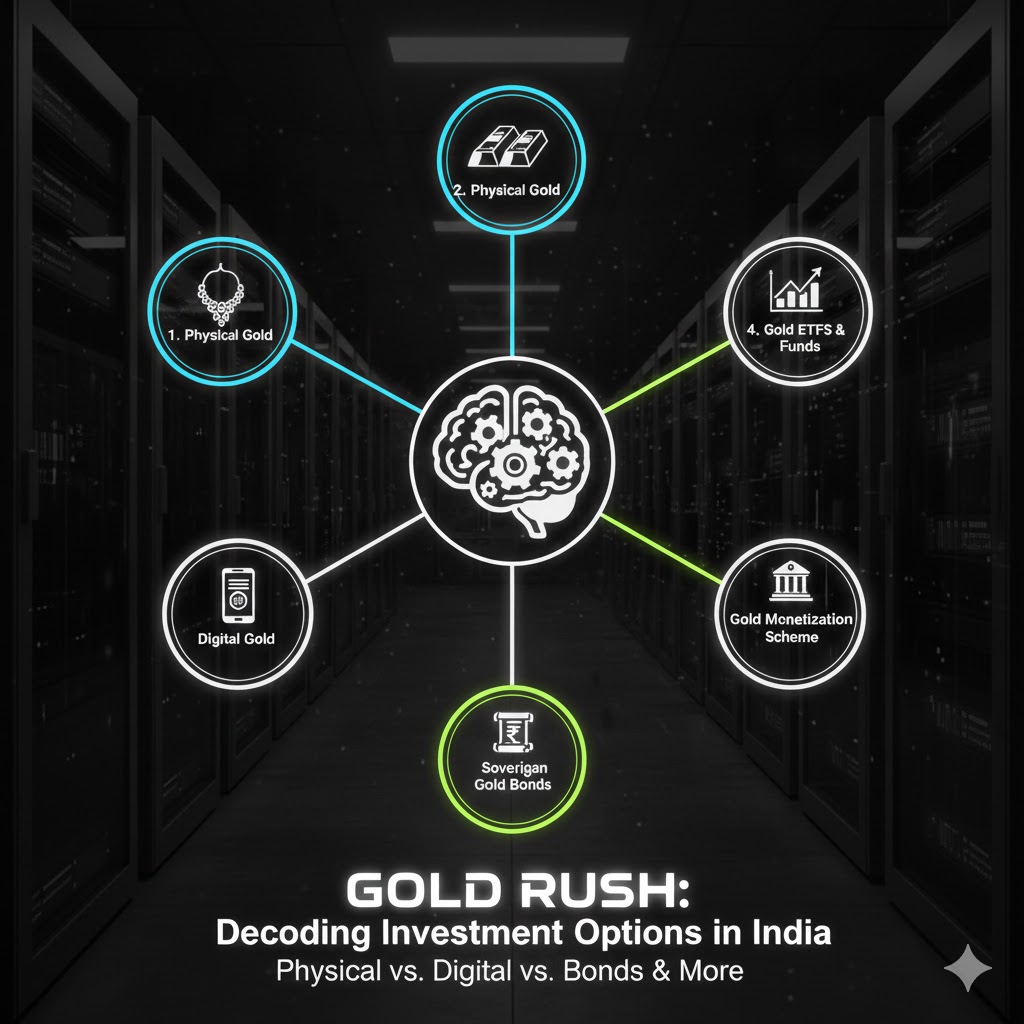

In India, gold isn’t just an ornament; it’s a revered asset class and a traditional hedge against inflation. For those looking to invest in gold, the landscape has evolved beyond physical forms. Understanding the nuances of physical gold India, digital gold, and sovereign gold bonds is crucial. Here’s a crisp look at your options.

1. Physical Gold: The Traditional Lure

This is the most common form of gold investment in India, involving buying gold jewellery, coins, or bars. While it offers tangible security and cultural value, physical gold comes with concerns like storage, making charges (for jewellery), and purity verification. Many still prefer it for its emotional connection.

- Creator Insight: For understanding the traditional market and purity checks, CA Rachana Ranade (YouTube: CA Rachana Ranade, Instagram: @carachana.ranade) often touches upon the practicalities of buying physical assets.

2. Digital Gold: Modern Convenience

Digital gold allows you to buy and sell gold in small denominations online through platforms like Paytm, Google Pay, or MMTC-PAMP. You own actual gold, stored in insured vaults, without the hassle of physical possession. This makes it a low-cost way to invest in gold for beginners in India and explains why digital gold has become popular among millennials in India.

- Creator Insight: Pranjal Kamra (YouTube: Pranjal Kamra, Instagram: @pranjalkamra) frequently discusses modern investment avenues, including the convenience and risks of digital gold platforms.

3. Sovereign Gold Bonds (SGBs): The Smart Choice

Issued by the RBI on behalf of the government, sovereign gold bonds are government securities denominated in grams of gold. They offer an annual interest (currently 2.50% p.a.) and are redeemed at the market price of gold at maturity. SGBs offer benefits of sovereign gold bonds compared to physical gold like no storage costs, no purity issues, and tax exemptions on capital gains if held till maturity. They are an excellent option for long-term gold as asset class investment.

- Creator Insight: For a detailed breakdown of how to buy sovereign gold bonds in India and their tax implications, Akshat Shrivastava (YouTube: Akshat Shrivastava, Instagram: @akshat.shrivastava.official) provides comprehensive guides.

Choosing between these gold investment options in India: physical vs digital vs sovereign gold bonds depends on your investment goals, risk appetite, and liquidity needs. Explore these options and leverage insights from financial creators to make informed decisions.